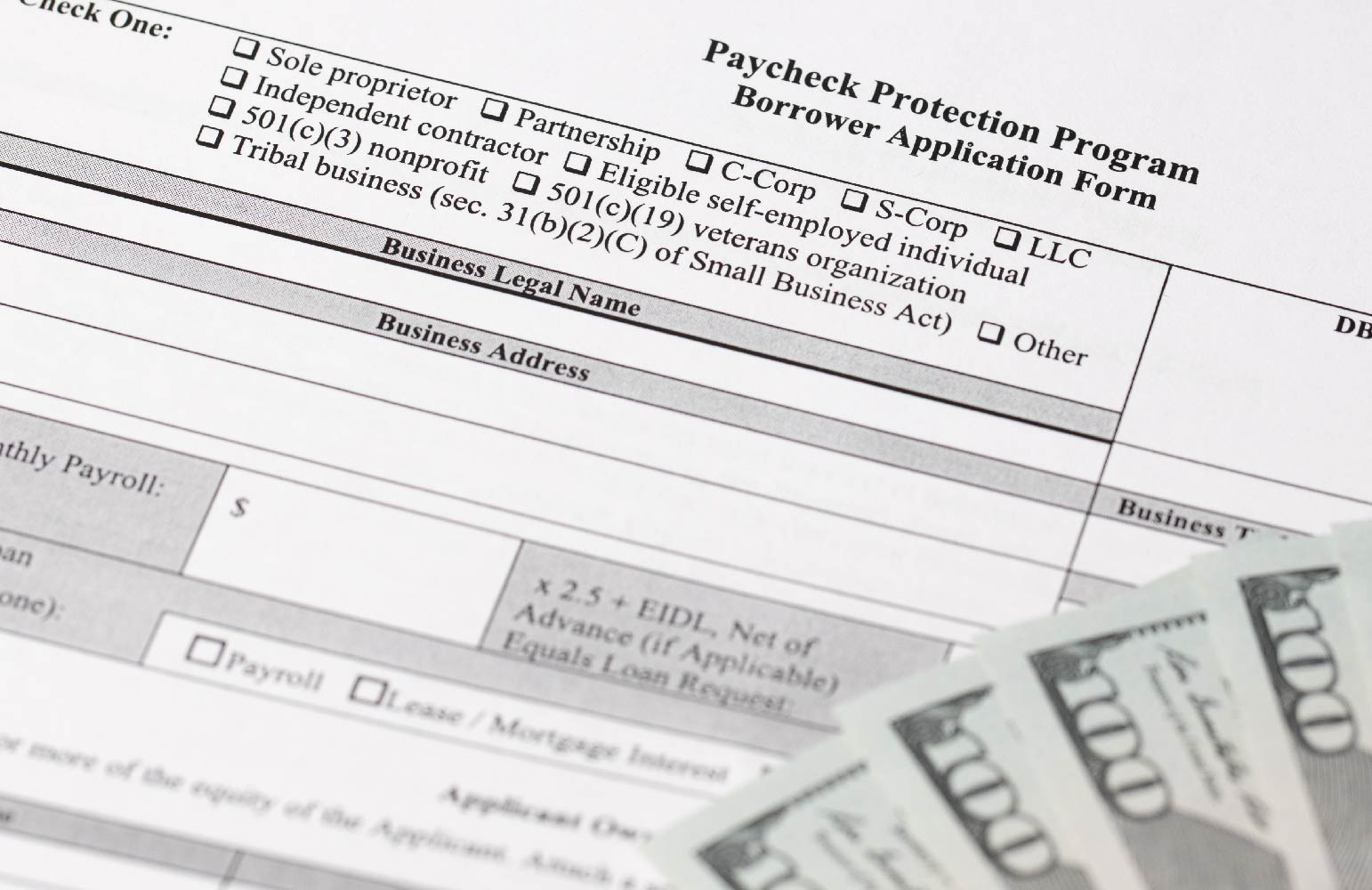

Congress Acts to Assist Businesses Continuing to Struggle with the Pandemic

By: Scott Borsack We are 14 months into the pandemic and though I am neither a scientist nor medical doctor, there seems to be a glimmer of hope that we may be approaching the corner on this virus. In the time that the economy has labored under the restrictions adopted by governmental authorities at… Continue Reading Congress Acts to Assist Businesses Continuing to Struggle with the Pandemic